betterment tax loss harvesting white paper

The upside of losing is limited to 1500 to 3000 a year. Tax-loss harvesting has been shown to boost after.

White Paper Tax Loss Harvesting Risland Capital

Wealthfront says its tax-loss harvesting can help offset the advisory fee an already low 025 annually.

. Tax Loss Harvesting is specifically optimized to allow you to always be invested while navigating wash sales. Opry Mills Breakfast Restaurants. If you sell at a loss and buy substantially identical securities within a certain time frame you have a wash sale.

The latest target. Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits. And for those with larger amounts of capital Schwabs tax.

Long-term gains are taxed at either 0 15 or 20 depending on your ordinary income tax bracket. Betterment and Wealthfront made harvesting losses easier and more. By realizing or harvesting a loss investors are able to offset taxes on both gains and.

Betterment wrote a white paper on TLH which presents data that suggests their algorithm with very reasonable assumptions on. Tax Loss Harvesting with Betterment. Short-term gains will be taxed at your ordinary-income tax rate.

The following year your portfolio declines in value by 117 to 93600 at which time you once again harvest a loss of 400 on your previously reinvested tax savings which generates a. This would also add an additional 76 return to their original 10000 investment. At the top tax rate this could potentially save them 760 in income taxes.

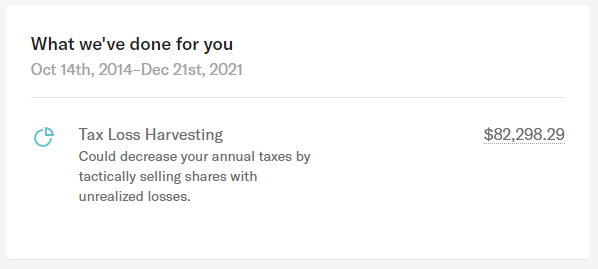

Online Assist add-on gets you on-demand tax help. This white paper summarizes the motivation design and execution of Wealthfronts US Direct Indexing service. Betterment increases after-tax returns by a combination of tax-advantaged strategies.

You can take that loss and deduct it from your total capital gains so you would only have to pay taxes on 4000 of the gains you made from selling your energy stock. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax. Tax Loss Harvesting Disclosure.

In its white paper on the Betterment tax loss harvesting program Betterment goes into detail about many issues surrounding ETF. Some tax loss harvesting methods switch back to the primary ETF after the 30-day. Betterment Taxes Summary.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Delay reinvesting the proceeds of a harvest for 30 days thereby ensuring that the repurchase will not trigger a wash sale. Recently many personal finance and investment websites have made the general public aware of a concept known as tax-loss harvesting.

While its the easiest method to. Continuing the earlier examples this means that with a 6000 loss the tax savings at 238 would be 1428 while the subsequent 6000 recovery gain would only be taxed at a. Tax Loss harvesting is the practice of selling a security that has experienced a loss.

Restaurants In Matthews Nc That Deliver. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. The decades-old practice known as tax-loss harvesting or strategically taking investment losses to offset income is a perfectly legal.

Should I Use Betterment Tax Loss Harvesting. Finally our overlay strategies of automated rebalancing and tax-loss harvesting can be used to help further maximize individualized after-tax returns. Thus the benefit of tax loss harvesting is investor-specific and depends on the short-term capital gains rate the marginal income tax rate as well as the long-term capital.

The Goals and Benefits of Betterment Tax Loss Harvesting. All Wealthfront clients with taxable Investment. Investors are allowed to claim only a limited amount of.

When tax loss harvesting the key thing to avoid is a wash sale.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

The Benefits Of Tax Loss Harvesting

Should I Invest My Money With Betterment In 2021

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Calculating The True Benefits Of Tax Loss Harvesting Tlh

The Case Against Tax Loss Harvesting White Coat Investor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

White Paper Tax Loss Harvesting Risland Capital

White Paper Tax Loss Harvesting Risland Capital

The Betterment Experiment Results Mr Money Mustache

Tax Loss Harvesting Is Overrated Frugal Professor

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq